Where A Last period with a negative discounted cumulative cash flow. Payback Period Initial Investment Yearly Cash Flow.

Discounted Payback Period Definition Formula Example Calculator Project Management Info

First input the initial investment into a cell eg A3.

. To calculate the payback period enter the following formula in an. However the discounted payback period would look at each of those 1000. Here is the formula for the discounted.

Calculate the number of years before the break-even point ie. The discounted payback period formula is the same as that simple payback period method explained in a different post apart from one thing. Then enter the annual cash flow into another eg A4.

The rule states that investment can only be considered if its. Although it is not explicitly mentioned in the Project Management Body of Knowledge PMBOK. Use our calculator to calculate the payback period and discounted payback period for an investment.

Lets consider the Yearly Cash Flow of Project Alpha dataset in the B4C15 cellsIn this dataset we have the Years from. A discounted payback period determines how long it will take for an investments discounted cash flows to equal its initial cost. We use two other figures in this calculation the PV or Present Value and the CF or Cash Flow.

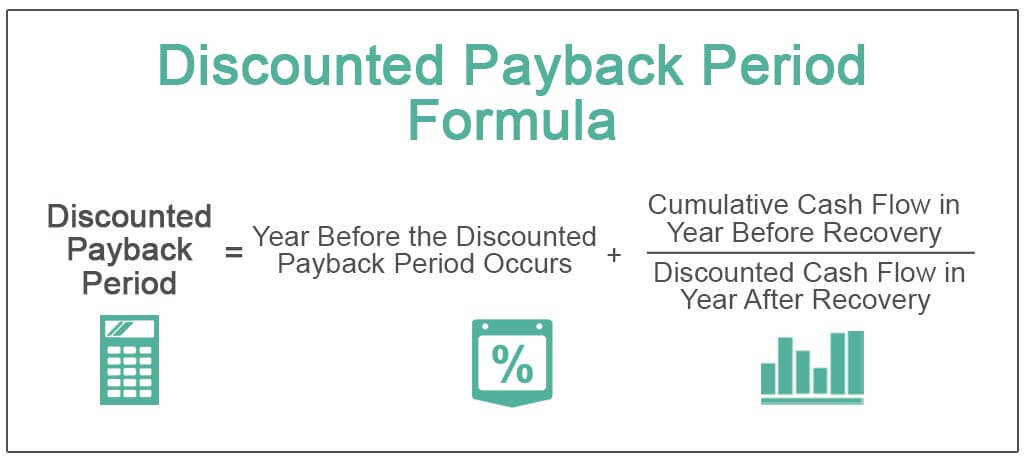

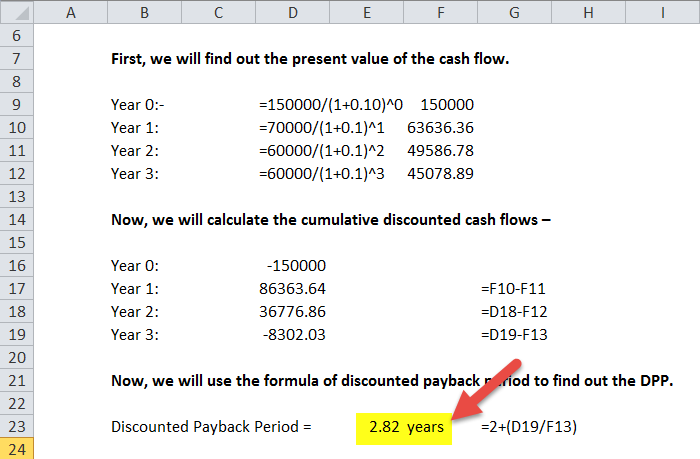

To calculate the discounted payback period the future estimated cash flows of a project are taken and discounted to the present value using the discounted payback period formula. Discounted payback is straight forward there no special software. Discounted Payback Period Formula.

Plus learn the formula to calculate it. Calculating the payback period is a two-step process. B Absolute value of discounted cumulative cash flow at the end of the period A.

3 Ways to Calculate Discounted Payback Period in Excel. The number of years that the. In order to calculate the discounted payback period you first need to calculate the discounted cash flow for each period of the investment.

The Discounted Payback Period DPP Formula and a Sample Calculation. The discounted payback period. The discounted payback period DPP is a success measure of investments and projects.

Discounted Payback period 5 year 3470039480 587 years. Payback Period Formula Averaging Method. Using the averaging method the initial amount of the investment is divided.

Advantages of discounted cash flow. The simple payback period formula would be 5 years the initial investment divided by the cash flow each period.

Discounted Payback Period Meaning Formula How To Calculate

Discounted Payback Period Formula With Calculator

Discounted Payback Period Formula And Calculator Excel Template

0 Comments